Introduction

It’s not uncommon for people to consider purchasing life insurance when their lives seem to be on the upswing, such as when the economy is doing well, they feel secure in their jobs, they’ve recently gotten married, or they have a child on the way. At this stage in life, most people begin to consider how they can best protect their families financially in the event of a catastrophic event.

This implies that during economic downturns, most people do not consider purchasing life insurance a required expenditure. This common misunderstanding can result in significant expenses, as life insurance is a great method to safeguard your loved ones whether or not the economy is doing well. On that note, let’s look at how life insurance can be a lifesaver during a recession.

In What Ways Does Life Insurance Help During A Recession?

1. Keeps Your Family Protected

Life insurance is a prudent investment to safeguard against financial hardship in the event of death. Having this kind of financial backing during tough times is crucial. If you have life insurance, not only will your loved ones not have to worry about funeral expenses but your debts and payments will also be taken care of.

When times are tough and money is tight, meeting these financial commitments can be more challenging. Buying life insurance coverage early can help you lock in the best rates, but it’s most cost-effective if you’re healthy and young.

2. Prevents You From Losing Your Home

When you pass away, your nearest and dearest will still need to cover the rent or mortgages. However, buying term life insurance can help with that. This is of paramount importance if you’re the sole breadwinner or if your wife and kids suffer financial difficulties without multiple incomes.

Having this sort of safety net is important during an economic downturn, especially when one or more family members may lose their jobs and the money coming in is lower than usual.

There are numerous reasons to buy term life insurance; however, perhaps the most compelling is the assurance that your loved ones would be safeguarded against the financial hardship of being forced to sell the family home in the event of your untimely demise.

3. It Can Help Payoff Debts

If you get fired from your job during a recession, you might resort to using credit cards to pay for necessities, and you might wind up with some credit card debt, just like many other Americans. If you have debt today or anticipate having a mortgage later in your life, a comprehensive life insurance plan can assist your loved ones in paying off your debts in the event of your death.

The death benefit can be used to pay off joint debts, such as a credit or debit card you and your partner share or a college loan you and your father cosigned.

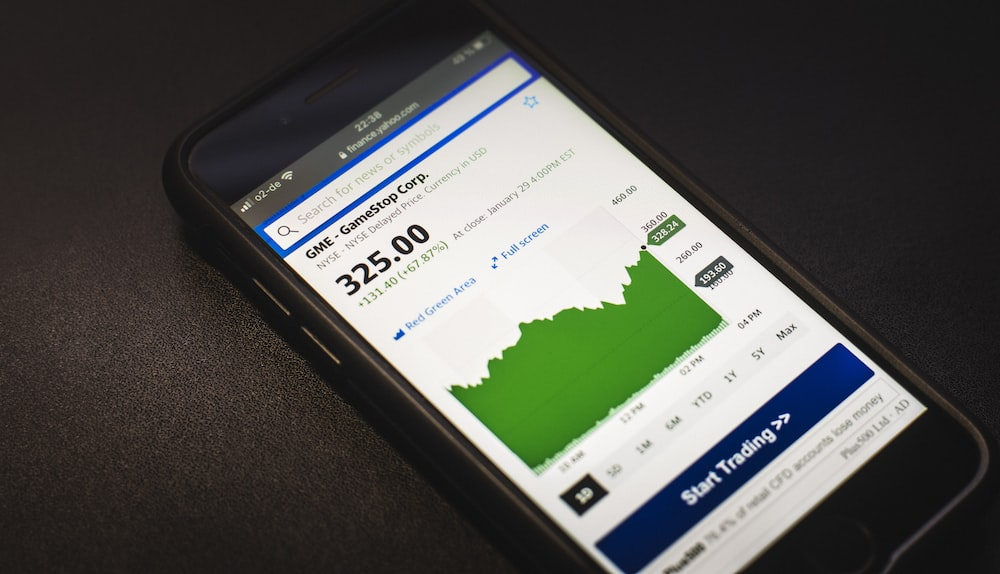

4. Helps Mitigate Stock Market Volatility

Numerous of us are worried about the potential decline in the monetary worth of our stock portfolios and retirement investments due to the recent high volatility in the stock market. If you or a loved one suffer a loss of income due to the stock market slump, life insurance may be able to help bridge the financial gap.

With term life insurance, you can rest assured that your loved ones will be provided for after your passing, regardless of the performance of your other financial holdings. Having that kind of calm can help you relax despite the volatility of the market.

5. Helps You Deal With Unexpected Situations

You can’t know for sure what the next several years will bring. Can you see yourself still employed? Is there going to be another pandemic? No one can predict what will happen in their life, so it’s wise to prepare for the worst by investing in life insurance. If something were to happen to you, having life insurance would ensure that your loved ones would be taken care of financially.

Get In Touch With Us

Looking for a life insurance agency that can help you during a recession? Get in touch with Franklin Life & Annuity right away. Whether you need life insurance for the entire family or require final expense insurance, we have it all.